The Hawai‘i Department of Taxation has announced the adoption of temporary rules relating to Pass-Through Entity (PTE) taxation, following approval from Governor Josh Green. The rules, which are effective seven days after public notice, are designed to implement changes under Act 50, Session Laws of Hawai‘i 2024, and carry the same legal weight as permanent administrative rules.

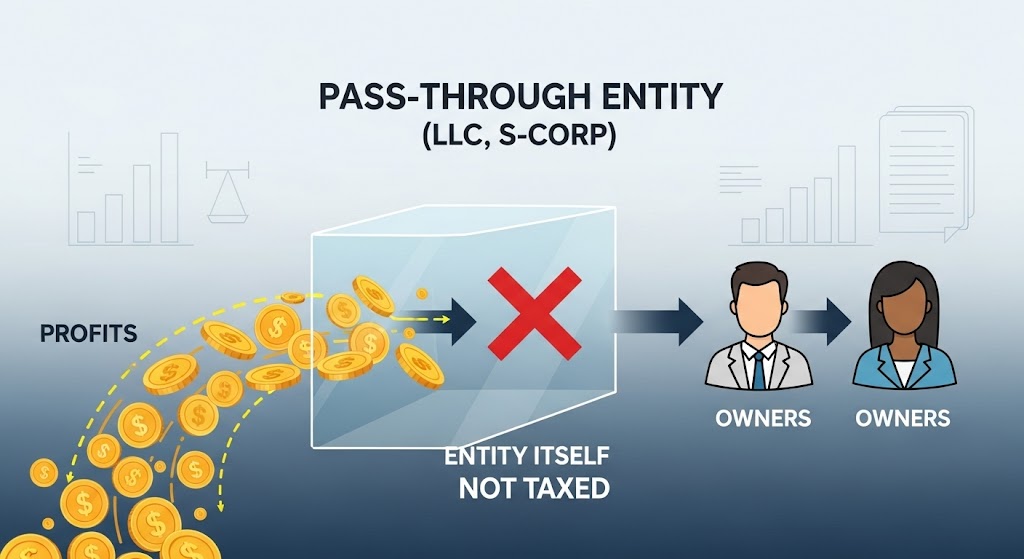

The new regulations, which amend section 235-51.5 of the Hawai‘i Revised Statutes, enable PTEs to elect to be taxed at the entity level. In doing so, the rules provide a tax credit to members whose distributive share or guaranteed payments of Hawai‘i taxable income are subject to the tax.

Additionally, the tax base for PTEs has been revised to include the sum of all distributive shares and guaranteed payments for “qualified members,” and the tax rate has been set at a flat 9 percent, down from the highest individual tax rate under section 235-51. Notably, the PTE tax credit can now be carried forward in subsequent years until it is fully exhausted.

These temporary rules will remain in effect for 18 months, after which they may be reviewed or adopted as permanent rules.

The temporary rules are available for review on the Department of Taxation’s website at tax.hawaii.gov and ltgov.hawaii.gov. They can also be obtained in person at the Department of Taxation’s Director’s Office, located at the Princess Ruth Ke`elikolani Building in Honolulu, as well as at district tax offices on Kaua‘i, Maui, and Hawai‘i Island.

For more information or to request a copy of the rules, individuals can contact the Department of Taxation’s Rules Office at (808) 587-1530.