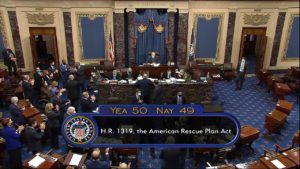

In this image from video, the vote total of 50-49 on Senate passage of the COVID-19 relief bill, is displayed on screen in the Senate at the U.S. Capitol in Washington, Saturday, March 6, 2021. (Senate Television via AP)

The American Rescue Plan passed the Senate on March 6, 2021, and it is expected to easily pass the House of Representatives and be signed into law by the president in the coming days.

Congress has passed several rounds of financial assistance and relief in response to the COVID-19 pandemic, including most recently the American Rescue Plan. The American Rescue Plan includes additional relief to small businesses struggling as a result of the pandemic.

New in the American Rescue Plan

- $25 billion nationwide for a new Small Business Administration (SBA) grant program specifically for restaurants and other food and drinking establishments impacted by the pandemic;

- $7.25 billion nationwide for additional first- and second-round Paycheck Protection Program (PPP) loans to small businesses and nonprofits until the program expires on March 31, 2021;

- Expanded eligibility for PPP loans for nonprofits and internet-only publishers;

- A change in interaction between the PPP and the Shuttered Venue Operators Grants;

- An additional $1.25 billion nationwide for the SBA’s Shuttered Venue Operators (SVO) grants, a new program created in the December COVID relief law; and

- An additional $15 billion nationwide of targeted funding for the SBA’s economic injury disaster loans (EIDL) emergency advance grants.

RESTAURANT GRANT PROGRAM

Eligible Grant Recipients

- Restaurants;

- Food stands, trucks, or carts;

- Caterers;

- Bars or lounges;

- Saloons, inns, or taverns;

- Brewpubs, tasting rooms, taprooms, or other licensed facilities or premises of a beverage alcohol producer where the public may taste, sample, or purchase products; and

- Similar businesses where patrons assemble for the primary purpose of being served food or drink.

This includes entities located in airport terminals and Tribally-owned concerns.

The following entities are not eligible:

- State or local government-operated businesses;

- Entities that own or operate (together with any affiliated business) more than 20 locations as of March 13, 2020, regardless of whether those locations do business under the same or multiple names;

- Publicly-traded companies; or

- Entities that have received a Shuttered Venue Operators (SVO) grant, or have a pending application for an SVO grant.

Grant Amount

The grant is equal to the business’s pandemic-related revenue loss: 2019 gross receipts minus 2020 gross receipts. Note: businesses are required to reduce their pandemic-related revenue loss by any amounts received under the Paycheck Protection Program (PPP).

If the eligible entity was not in operation for the entirety of 2019, the difference between:

- The product obtained by multiplying average monthly gross receipts in 2019 by 12; and

- The product obtained by multiplying average monthly gross receipts in 2020 by 12; or

- An amount based on a formula determined by the SBA at a later date.

If the eligible entity opened after January 1, 2020:

- Payroll costs incurred, minus any gross receipts received; or

- An amount based on a formula determined by the SBA at a later date.

The maximum grant size is $10 million per entity, limited to $5 million per physical location.

Distribution of Grants

- $5 billion of the $25 billion total is earmarked for the smallest businesses. Defined as those with 2019 gross receipts of $500,000 or less.

- The remaining $20 billion is available for SBA to award grants in the order in which applications are received, but in an equitable manner based on applicants’ annual gross receipts.

- During the program’s first 21 days of operation, SBA will give priority to applications from businesses owned and operated by women, veterans, and socially and economically disadvantaged individuals (as defined in 15 U.S.C. 637(a)(4)(A)).

Use of Funds

Grant funding can be used for a wide variety of expenses, including:

- Payroll costs;

- Payment of principal or interest on any mortgage obligation (not including prepayment of principal);

- Rent, including rent under a lease agreement (but not including prepayment of rent);

- Utilities;

- Maintenance expenses, including construction to accommodate outdoor seating and walls, floors, deck surfaces, furniture, fixtures, and equipment;

- Supplies, including protective equipment and cleaning materials;

- Food and beverage expenses within the scope of normal business practice;

- Covered supplier costs;

- Operational expenses;

- Paid sick leave; and

- Any other expenses the SBA determines to be essential to maintaining the eligible entity.

Applicant Certification

Applicants must certify that the uncertainty of current economic conditions makes the grant request necessary to support ongoing operations, and that they have not applied for an SVO grant.

Tax Treatment

- The ARP exempts SBA restaurant grants from gross income for tax purposes, and provides that such exclusion will not result in a denial of deduction, reduction of tax attributes, or denial of increase in basis.

- For partnerships and S corporations, the grant amount is treated as tax-exempt income for purposes of sections 705 and 1366 of the Internal Revenue Code, and the bill directs the Secretary of Treasury to prescribe rules for determining a partner’s distributive share of amounts received through the restaurant grant.

The full factsheet on this grant program is available here.

PAYCHECK PROTECTION PROGRAM

The American Rescue Plan provides $7.25 billion nationwide for additional first- and second-round Paycheck Protection Program (PPP) loans to small businesses and nonprofits until the program expires on March 31, 2021. More information about the PPP program can be found here.

Expanded eligibility for nonprofits and internet-only publishers

- PPP eligibility is extended to additional nonprofits listed in Section 501(c) of the Internal Revenue Code, provided that: 1) the organization does not receive more than 15 percent of receipts from lobbying activities; 2) the lobbying activities do not comprise more than 15 percent of activities; 3) the cost of lobbying activities of the organization did not exceed $1,000,000 during the most recent tax year that ended prior to February 15, 2020; and 4) the organization employs not more than 300 employees.

- Eligibility is also extended to internet-only news and periodical publishers, as long as the business has no more than 500 employees per physical location (or the applicable SBA size standard for that North American Industry Classification code). The organization must certify it is an internet-only news or periodical publisher and that the loan will support locally-focused or emergency information.

Interaction with Shuttered Venue Operators grants

The American Rescue Plan allows eligible entities (e.g., theaters, museums, live entertainment venues) to access both PPP and the SBA’s Shuttered Venue Operators (SVO) grant program, which was previously prohibited. An entity’s SVO grant amount will be reduced by the amount of PPP loans received on or after December 27, 2020. More information on the SVO program can be found here.

Previously announced revisions to PPP

On February 22, 2021, the Biden administration announced the following revisions to expand access to PPP loans:

- The SBA will revise the PPP loan formula for sole proprietors, independent contractors, and self-employed individuals so they can receive more financial support;

- The SBA will expand eligibility to include:

- Small business owners with prior non-fraud felony convictions;

- Small business owners who have fallen behind on student loan payments; and

- Non-citizen small business owners who are lawful U.S. residents and have an Individual Taxpayer Identification Number (ITIN).

SHUTTERED VENUE OPERATOR GRANTS

The American Rescue Plan provides an additional $1.25 billion nationwide for the SBA’s Shuttered Venue Operators (SVO) grants, a new program created in the December COVID relief law. The SBA is still working to operationalize the program and open it for applications. The American Rescue Plan also allows eligible entities to access both SVO grants and PPP loans, which was previously prohibited by the December relief law.

More information about the SVO grant program is available here. The SBA’s website, which is being updated regularly, also includes a Frequently Asked Questions section and a preliminary application checklist.

EIDL EMERGENCY ADVANCE GRANTS

The American Rescue Plan provides an additional $15 billion nationwide of targeted funding for the Small Business Administration’s (SBA) economic injury disaster loans (EIDL) emergency advance grants. More information is available here.

Please note: SBA is currently limiting consideration for advance grants to those who applied for EIDL assistance on or before December 27, 2020. This is to prioritize applicants who received capped advances or were unable to obtain an advance after funding ran out in July 2020. If you meet this description, do not submit a duplicate EIDL application. SBA will contact qualified applicants directly.